Tax Planning AI Software

to Unlock Advisory Opportunities

Meet Tax Maverick—the Tax Planning AI Software that guides a client conversation, analyzes source docs, models strategies, and auto-builds a client-ready plan. This is practical software for tax planning for firms that want to stop grinding on low-fee prep and start delivering high-value advisory—without hiring an army or reinventing your process.

Join 100+ companies already saving time and resources

Features

Why choose Tax Maverick

Tax Planning Software that uncovers missed savings

Goos, our AI assistant, scans returns and financials to find strategies most accountants miss — model scenarios and deliver client-ready plans in minutes. See how our AI tax planning platform converts preparation into high-value advisory.

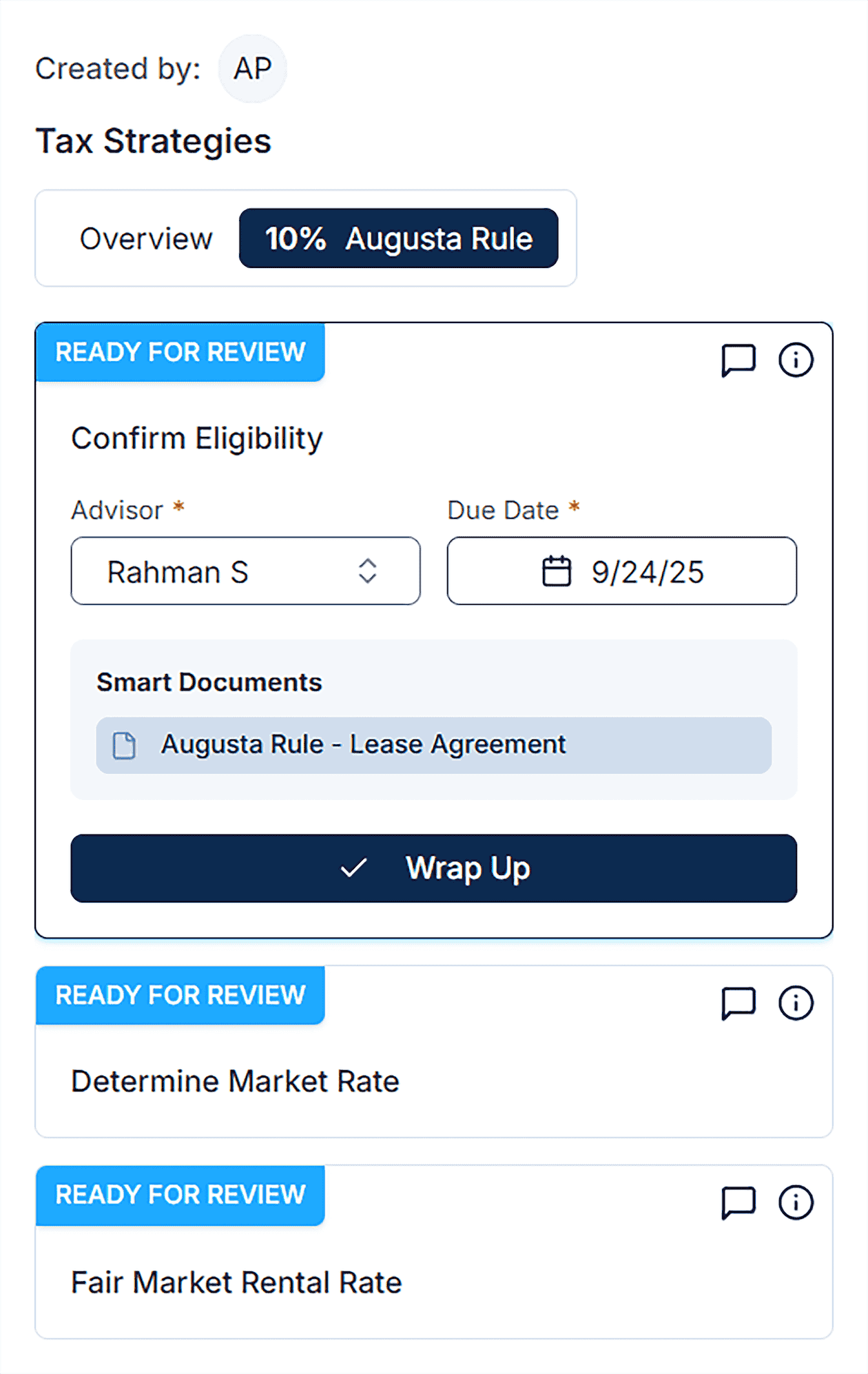

Built-In Guidance

Eliminate the uncertainty around tax strategies. Our AI assistant, Goos, provides step-by-step guidance so you deliver the most effective and impactful solutions for your clients. Tax Maverick's

Put an End to Scope Creep

Tax Maverick gives you clear, tangible deliverables that show exactly what you'll provide and how you'll provide it. This removes confusion, helps clients see the full value of your work, and ensures you get paid what you're worth. Our platform creates repeatable templates and client-ready plans so scope and pricing are clear.

Grow with a Community

Tax Maverick connects 800+ tax professionals who share templates and playbooks. When teams ask What is the best ai accounting software for taxes, they choose platforms that combine tax-domain rules with explainable recommendations — Tax Maverick is Tax Planning Software that helps firms scale advisory, share workflows, and sell client-ready plans.

A Future Beyond Taxes with AI Software

At Tax Maverick, we're redefining what's possible in modern advisory. For firms wondering what is the best AI accounting software for taxes, our platform delivers the answer—empowering professionals with tools that go beyond compliance. We help advisors guide clients to invest smarter, grow their businesses, and build lasting wealth through AI-driven insights and strategic planning.

How It Works

Inspire

Present your findings with ease—share reports, collect e-signatures, and manage payments in one place. With ready-to-use PowerPoint templates, you can confidently guide client meetings and highlight key insights.

Analyze

Our AI analyzes client data to identify eligible tax strategies and generates a detailed Tax. Savings Assessment Report—saving time while maximizing client results.

Pricing

Use advanced pricing tools and ready-to-send deliverables to confidently price your services and clearly show clients the value they'll receive.

Advise

Present a polished plan and proposal generated by your Tax Planning Software and enroll clients with confidence.

Still asking “What is the best AI accounting software for taxes?” Adopt

the system that streamlines assessments, formalizes strategy, and

standardizes delivery.

Testimonials

Why trust Tax Maverick?

Tax Maverick was built by practitioners who lived the high-volume grind, then

cracked the advisory code—moving from ad-hoc consults to a scalable

assessment-first model. The platform reflects those field-tested systems so any

team member can execute consistently.

Compared with generalist prep tools and practice managers, this Tax Planning

Software is engineered for strategy delivery, not just filing or task management. The

broader landscape (TurboTax, TaxDome, Holistiplan, Corvee, TaxPlanIQ, Drake)

confirms there's a gap between filing, practice ops, and deep planning;

Tax Maverick is built to fill that gap for professionals who lead with tax strategy.

If you've been evaluating the market you'll find our differentiation in assessment-first

workflows, automated modeling, proposal generation, and practice-level tracking.

Trusted by 1,001 firms to uncover over $449,410,173 in client tax savings.

"With Tax Maverick, they are easy to collaborate when it comes to feedbacks, they helped us CPAs and Tax Advisor to create what we want - it has saved me time."

Pam Brar

CPA, Tax Strategist

"Since I started using Tax Maverick, I have streamlined my processess and began focusing on Tax Effecient Exit Planning.

Tax Maverick is the best bolt on service offering for my advisory service and could be an easy addition to any other accounting or Tax Compliance Business."

Robert Green

Tax Strategist

"Life is a lot easier with Tax Maverick! It's faster and easier.

I looked at the other tax planning programs went with the Tax Maverick cause it's very efficient and it followed through with what it says, and that is a very important thing to me."

Santos Gutierrez

Tax Planner/Advisor

"When I look a Tax Maverick, I was thinking to myself there's got to be a way to build a spreadsheet that formulates all these strategies and was about to work on that until I found about Tax Maverick, and that pretty much changed a lot of things.

I am very impressed with the software. Tax Maverick gives me a more professional standpoint, now I have a tool that I know that by applying these strategies will benefit tax payers."

Kevin Martinez

Registered Tax Preparer

"I was always seeking ways to refine my approach and deliver more value to my clients. I was looking for a more structured and effective way to streamline my Tax Planning Process.

When I joined Tax Maverick within the first month, I sold about three assessments, and was able to save a significant amount of money for my clients by using a more systematic approach."

David Boatswain

10 Years Tax Planner

"Tax Maverick has changed my mindset, after joining Tax Maverick, I was able to sell and get paid upfront my first tax assessment within four days. It's AI supported and it's just very simple and very easy to use."

Anne Liang

CPA

Why Tax Planning Software

Matters for Modern Firms

In today's rapidly changing financial landscape, firms that rely solely on tax preparation are

leaving growth on the table. Tax Planning Software empowers professionals to move beyond

compliance and deliver proactive, high-value advisory services that strengthen client

relationships and boost profitability. By automating data analysis, modeling tax strategies, and

generating client-ready proposals, it transforms complex tax work into scalable, repeatable

advisory processes. For modern accounting practices that want to future-proof their business,

adopting intelligent Tax Planning AI Software isn't just an upgrade it's a competitive advantage.

FAQs

Ready to lead with strategy?

Launch your first plan with our Tax Planning Software.

No obligation—cancel anytime